In the table below we have mentioned some of the top financial modelling colleges in India. The Financial Modeling course will provide you with a good understanding of the concept of finance. Accounting, finance are among the basic financial modelling subjects covered in the Financial Modeling course. Investment bankers are professionals who work for a finance company and are largely involved in raising cash for private firms, governments, and other organisations. Investment bankers are instructed how to save time and money by recognizing risk in a project before it moves ahead. The learning takes off from intermediary level towards the advanced level of creating models, through a 6 step approach starting from Financial statement modeling and ending at LBO modeling.

IMS students enrolled in any Program (CAT, CET/CMAT, GMAT, GRE, BBA, Law) and in all Learning modes (classroom, correspondence, test series, Live, & Self-Learning Programs) are eligible for a 20% loyalty waiver. After receiving NSE Academy certification, Proschool provides additional certification of VBA & Macros and Mergers & Acquisitions via online training. IMS Proschool pioneered the FM training in the country and has trained 6,000+ students. A 55 hrs+ Live Online Training Program leading to certifications from NSE Academy, NSDC, and IMS Proschool. Bsevarsity.com enables you to master the concepts, interact with expert faculty and other learners, and be a part of the community whilst growing.

Get industry recognized certification – Contact us

This government certification program on financial modeling tests your knowledge as per the organization’s requirement for building financial models for analyzing firms, IPOs and FPOs. Besides, it provides you with knowledge in several areas in financial modeling as well as valuation principles. Following are some important details and the course outline that you should know before enrolling in this course. The FM qualification is a certification intended exclusively for finance experts who desire to enhance their Financial Modeling skills. More than 3 lac companies use Internshala to hire interns and employees and hence they will recognise a certificate from Internshala when they see one on your resume.

Financial Modelling has become one of the crucial skills demanded by numerous companies, investment banks, and businesses. In the past few years, Financial Modeling has acquired a place in the list of core skills in the present corporate sector. Career Bulls institute is an excellent place to learn Financial modelling and valuation. Experienced in the execution of wide range of Investment Banking analysis.

Sit the Exam

One of the best Institute for learning SAP FICO,Accounts, Income Tax, GST and payroll, Tally. All the faculties are very professional and very cooperative. The costs for other courses range from INR 10,000 to INR 10 lakh. The duration of the Financial Modeling course is determined by the course that is selected by the students. Certificate programme’s duration can be from 1 day to three months, whereas the diploma course is of six months to 1 year. The duration of UG and PG programmes is of three years and two years respectively.

- When it comes to Financial Modelling, there are a number of academic institutions, both public and private that offer this course.

- The workshop can be attended by anyone who is looking to secure a job, internship or any responsibility in a corporate or a startup.

- Personality fit as well as technical knowledge is the final test.

- The Financial Modeling course is designed to teach students the necessary skills and information to work in the finance industry.

This course is also offered by Wharton School, on Financial Modeling through Coursera. This program will assist a student to harness the power of spreadsheets to map and predict data, read income and cash flow statements, and creation of quantitative models. Career bulls institute is an excellent place to learn Financial modelling and valuation. The faculties themselves are well experienced and are very helpful and cooperative and clear all doubts.

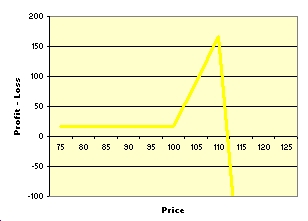

In a stock market analysis, we look at the past performance of a company as project what the revenue, costs and profit of the company are likely to be and therefore if we should buy, sell or hold that share. Jobaaj Learnings offer the best in class industry-focused programs to students. We are the pioneer of a personalized micro-learning education model in India.

I am an Engineer. In what way financial modelling can help me ?

This course is for students with no prior knowledge about the subject. People who want to get a basic knowledge about this skill can go for this course. The faculty brings their real life business scenarios into the classroom, to simulate the actual working of an investment bank, using classroom discussions and case studies. Besides, they also run their own Investment banking firm due to which their curriculum remains up to date. Your gate way to career in Equity Research, Investment banking, Credit Research, project finance & business Analysis. “Very effective faculty for Financial modeling and prep for CFA level 1. Helped me in clearing both and helped me landing into relevant job… Owner is pretty experienced and humble guy, keeps you motivated for career plan.”

Is CFA good for financial Modelling?

When you are a financial modelling CFA professional, you are at a significant advantage. The CFA course opens up opportunities in specific fields like investment banking, credit analysis and equity research. These areas also require you to be adept at financial modelling.

Financial Model includes the Projection of Income Statement, Balance Sheet and Cash Flow Statement. Financial Modelling and Valuation is the most required skill in Equity Research, Investment Banking, Project Financing, Credit Research, Hedge funds or any other mainstream Finance profile. Financial Modelling and Valuation Course by IB Institute, offering Live classroom course as well as Online Financial Modelling Training for students and working Professionals.

Gain A Solid Understanding Of Financial Analyst

Find information around eligibility, career scope, jobs , colleges and exams and much more for free. Financial modelling can lead to a number of job opportunities in Investment Banking, Asset Management, Property Management, Financial Health, Mutual Fund Research, and Risk Assessment, among other fields. Certificates, diplomas, and postgraduate diplomas are among the formats available.

In addition to using advanced tools of Excel, one also learns to model various kinds’ financial situations. Investment Banking Institute is one os the oldest institute for Financial Modelling and Valuation Course. Managing your LinkedIn profile as most of the recruiters are checking your LinkedIn profiles before financial modeling certification scheduling your interview. Basic Excel starts from very very basic and goes to a very advanced level gradually. “Financial Modeling Online Course” videos are for educational and information purpose only. We advise you to understand the strategies well and use your own discretion to use them in live markets.

There is no minimum qualification required to pursue the Financial modeling course. But due to the complexity of the course, it is easier for students with mathematics, statistics and economics background to understand the concept of Financial Models. Financial Modeling Course is emerging as one of the most highly sought after pre-requisites for finance professionals in India. Using different approaches like lowest common denominator and annual equivalency cash flow for determining the value of projects that have different life spans. To add-up the credible pinch to your CV, a certification for successful completion of workshop is provided after the end of the training program, which is industry recognized. The WallStreet School provides 100% placement assistance to the delegates who have successfully completed one of our Investment Banking training programmes.

Industry Experts who have ample experience in the field are the tutors of the course. Tim Vipond, CEO of CFI, is the lead instructor, and since, 2005 he’s been an active participant in capital markets worldwide, including M&A, Valuations and Capital raising. One is the Self-Study package, accessible for $497, and the other is the Full Immersion package for $847. The instructions are imparted by faculties of 365 Careers Inc. They are well-known for their knowledge in the field of Business, Finance and Data Science. The course is way too affordable with a massive discount offered by Udemy.

Financial Modeling is an important aspect of investment banking. It is the projection of a set of financial figures obtained by performing calculations. These figures are then used to make recommendations for a company’s financial growth. The recommendations are focused on some future point on the basis of certain assumptions.

Exam Specific details

This programme will help you to create financial models, use such models for funding proposals, credit rating or business valuation and take decisions by analyzing such models. Financial models are important tools for all business decisions. When you’re looking to raise finance, buy or sell a business, assess strategic options, or simply plan for the future, you are going to need a forecast. Finance professionals usually need to work with large volumes of numerical data. However, the key to successfully handle such data is the ability to organize and structure it meaningfully to render them useful to senior management for decision making. This entails the creation of robust and dynamic financial models facilitating accurate and efficient analysis of historical data and appropriate projection of financial performance.

What is financial Modelling certification?

CFI's Financial Modeling & Valuation Analyst (FMVA)® Certification Program will teach you essential skills required to perform practical financial analysis. Financial models are a critical part of the decision-making process in the finance industry today.

My special thanks to Himanshu & Puneet Sir for their valuable guidance and support throughout the journey. It is one of the most widely valuation techniques by investment bankers and finance professionals. Under this we would learn how to build a detailed trading comps right from the selection of peers to the analysis of final output. We would also understand how to compare and use these multiples as a valuation technique, what could the possible reason for differences in the multiples and how to tackle those differences etc.

Get an in-depth understanding of complex securities and derivative products, their trade lifecycles, and the functions within investment banking operations. The student reviews talk about the direct support of the lead instructors and professional guidance they received throughout the training. In addition, the lucid course structure aids students in obtaining practical knowledge slowly and gradually.

Is financial modeling certification worth it?

' The simple answer to this question is yes. The Financial Modelling certification is surely worth it if you are planning to enter the field of finance. The reason why it's important is that financial modelling is the first step to financial planning, analysis and management.