Contents:

Usually, the commodity futures price in the exchange is the spot price plus cost-of-carry. That would not pose an issue if the costs for futures contracts in several months had been the identical. In specific, for a market that’s in contango, the worth of the replacement futures contract might be greater than the value of the contract that just expired.

Asia oil/products: Dubai flips back above Brent, dist cracks fall again – Quantum Commodity Intelligence

Asia oil/products: Dubai flips back above Brent, dist cracks fall again.

Posted: Fri, 28 Apr 2023 10:44:20 GMT [source]

We shall also look at how this contango and super contango impact the spot prices and what are the circumstances under which contango and super contango come about. We shall also look at terms like the contango market and contango meaning in practical terms. Normally, costs like insurance and storage will be highest on a per unit basis for shorter periods and costs tend to average to lower levels at longer contract terms. Contango can also be looked at as the price you pay for securing your pricing for a longer period. However, there are also occasions when the shorter duration contracts cost more than the longer-dated ones. That’s an inverted market or backwardation and it shows the reverse of a normal contango market.

Basis, contango, and backwardation

The change in the value of the asset from the spot time to the end of the contract time will be your profit or loss, which you must bear. Lame-duckis an out-of-use term used with reference to a trader who has defaulted on a debt or gone bankrupt due to an inability to cover trading losses. The non-compliant demat accounts will be frozen for debits by Depository Participant or Depository. Trading in “Options” based on recommendations from unauthorised / unregistered investment advisors and influencers. Pay 20% upfront margin of the transaction value to trade in cash market segment.

What’s Keeping Oil From Rallying? – Baystreet.ca

What’s Keeping Oil From Rallying?.

Posted: Tue, 25 Apr 2023 10:46:55 GMT [source]

When the prices are higher for longer-dated contracts, the market is in contango. You pay more for materials delivered later to cover the costs of the merchant who has to hold the commodity longer. Is part of the IIFL Group, a leading financial services player and a diversified NBFC. The site provides comprehensive and real time information on Indian corporates, sectors, financial markets and economy.

What is Premium in Futures and Options?

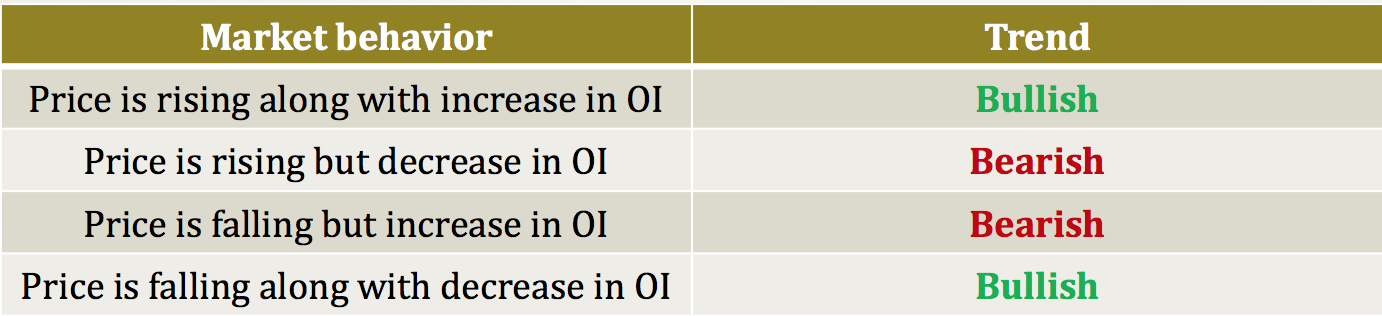

Contango occurs in a market when futures prices for a commodity are greater than the current spot price. Backwardation happens in a market when the price of futures contract is below the spot price of the same commodity. An unexpected strengthening of the basis from time benefits the seller of a commodity, such as a commodity producer.

In other words, as the time passes, the basis could change in either direction. Depending on this change, the basis could either be strengthening or weakening. If the spot price of a commodity is outperforming the futures price, the basis is said to be strengthening.

Mutual fund Investments

It is quite usual for non-perishable goods that have high https://1investing.in/ costs. When the spot price becomes greater than the futures price, the situation is called backwardation. Anunexpected strengthening of the basis from time benefits the seller of a commodity, such as a commodity producer. This is because the outperformance of the spot price relative to the futures price enables the seller to fetch a higher selling price from the local spot market. For instance, let us assume that a gold producer wants to sell gold three month from today, say on 15th June.

A trader could buy this futures contract on the assumption that the price of natural gas will fall below £900 before the expiry date arrives. In this chapter, we will be covering concepts related to basis, contango, and backwardation. These concepts are especially important in commodities given that commodities are physical assets that have a limited supply and as such are heavily influenced by the demand and supply scenario prevailing across the globe. We will take about them in more detail over the course of this chapter. In backwardation, the spot price is higher than future prices and generates a typical downward sloping forward curve. Backwardation could occur in physically-delivered contracts because there may be a benefit to owning the physical material, such as keeping a production process running.

Futures prices are determined by the futures market, where participants trade contracts that promise to buy or sell a commodity at a specific price on a future date. For merchants and investors, lower futures costs or backwardation is a signal that the present value is just too high. As a end result, they count on the spot price will ultimately fall as we get closer to the expiration dates of the futures contracts. Rolling contracts provides one other dimension – and another chance for loss or achieve – to commodity investing.

Trading in leveraged products like options without proper understanding, which could lead to losses. You are accessing this website at your own risk and it is your responsibility to take precautions to ensure that it is free from viruses and other items of a destructive nature. The Documents do not constitute, and may not be used in connection with, an offer or solicitation in any place where offers or solicitations are not permitted by law. If you have gained access to this website and the Documents contrary to any of the restrictions herein, you are not authorized and will not be able to purchase any of the securities described in the Documents. Please note that because of restrictions imposed by applicable law or regulation on soliciting securities business in various jurisdictions, subscription to the Issue will not be permitted to residents of certain jurisdictions. Please note the trading/delivery lot varies from exchange to exchange.

Futures contract contracts for conveyance of products, and one can give conveyance of merchandise against futures contracts relying on the conveyance rationale of the agreement plan. However, not all commodities of futures contract have a delivery mechanism. These terms are two fundamental facets of derivative trading that a trader must know before they start trading them , be it in the equity, commodity, or currency segments.

The term implies that in later months of the contract, the costs of storing, insuring, and paying interest on a given quantity of a commodity were fully accounted for compared with the current month. Whereas if you are short, the roll yield will be positive because you get to short at a higher price as the futures price in contango is higher than the spot price and previous month futures price. Basis is positive when spot price is above the futures price, and negative when spot price is below futures price. For instance, if the price of spot gold in local market is ₹32,000 and the price of a nearby gold futures contract on the MCX is ₹32,050, there is a negative basis of ₹50. On the other hand, if the price of spot gold in local market is ₹32,000 and the price of a nearby gold futures contract on the MCX is ₹31,950, there is a positive basis of ₹50.

ICICI Securities is not making the offer, holds no warranty & is not representative of the delivery service, suitability, merchantability, availability or quality of the offer and/or products/services under the offer. The information mentioned herein above is only for consumption by the client and such material should not be redistributed. Contango usually occurs when an asset price is expected to rise over time.

If the basis weakens over the next three months, say from ₹50 to ₹25, the effective net purchasing price would decrease to ₹32,025 from ₹32,050, thereby benefiting the consumer who was able to buyat a lower price. Take a Future on the Nifty which is trading at a spot of 17,350 and the futures price is 17,520. Therefore, the futures premium, in this case, is 170 points for a one-month contract or 0.98%. However, when you hold the futures contract for 1 month there is an interest cost for the margin of around 40% that has been paid. Let us assume that the cost of carrying, in this case, is Rs.100, which is the interest cost of holding the futures contract.

What Is Contango?

In India, three sectoral indices are allowed for trading on MCX and these are BULLDEX, METLDEX and ENRGDEX. This spread is executed by a trader or investor by taking long and short positions in two future contracts with different maturities but within the same commodity. Calendar spreads are further divided into two types viz., bull spread, and bear spread. Bull spread means buying far month contract and selling current month contract and bear spread is reverse of bull spread. Contango means a situation, where futures contract prices are higher than the spot price and the futures contracts maturing earlier. It arises normally when the contract matures during the same crop season.

Contango Meaning, Why It Happens, and Backwardation – Investopedia

Contango Meaning, Why It Happens, and Backwardation.

Posted: Sat, 18 Mar 2023 07:00:00 GMT [source]

And as per the list of national emergencies within the united convergence principle, the long run value ought to be downward sloping to equal the price at maturity. However, different palladium contracts have different delivery dates and hence different prices. In mid-August, the price for September-dated palladium was $2,209 an ounce. If you wanted to wait until December for delivery, you would pay more—those contracts were priced at $2,238.50 an ounce.

Basis risk

Contango occurs when the worth of a futures contract on an underlying asset is above its expected future spot worth. The forward curve indicating the prices of futures for different expiries indicates that spot is lower than the futures quotes, hence a Contango market. It is fair to expect futures markets to have more extended delivery contracts priced higher than closer delivery contracts as it costs money to buy and/or store the underlying product for that extended period. Let’s assume that the spot price of natural gas is £1000, but the price of a natural gas futures contract is £900 for delivery in one month.

In commodity futures, all these factors are normally present, especially when you are trading futures on commodities for physical delivery. However, when you trade in equity or index futures, the contango only consists of the interest or opportunity cost and the bullishness factor. Hence, contango by default is bullish as it shows a high element of bullishness in the asset class. It shows the expectation that spot price will scale higher in the future. In the commodity derivatives market, there are two types of trading strategies namely directional and non-directional. In directional trading, traders take regular buying and selling based on market movement and prediction.

Normally, one reason for backwardation is when there is an unexpected surge in demand that suppliers cannot meet with an instant increase in output. Investments in securities market are subject to market risks, read all the related documents carefully before investing. None of the research recommendations promise or guarantee any assured, minimum or risk free return to the investors.

- The forward curve indicating the prices of futures for different expiries indicates that spot is lower than the futures quotes, hence a contango market.

- The reason Contango is a problem is because if you are long on the futures, you need to roll it over each month.

- The contents herein above shall not be considered as an invitation or persuasion to trade or invest.

- Hence this expectation of future price is considered to be positive only when the future is more than the spot price plus the cost of carrying.

If the contract is not executed, the premium is an earning for the call option seller/put option buyer. Futures and options are meant to protect you from the price movements of underlying financial assets as your exposure is limited and indirect. Contango is a situation where thefutures price of a commodity is higher than the spot price. To ensure smooth settlement of trades, the investors are requested to ensure that both the trading and demat accounts are compliant with respect to the KYC requirement.

It must be kept in mind that these opportunity costs are just one factor that determine the futures price. The other factor that has a significant bearing on the cost of carry is the prevailing demand and supply situation for a commodity. An example of Contango in the stock market would be if a futures contract for a particular stock is trading at Rs. 110 per share for delivery in 3 months, while the current market price for that stock is Rs. 100 per share. This would indicate that the market expects the price of the stock to increase over the next 3 months, and the futures price reflects that expectation. As the cost of carrying increases, the futures price will increase further if more storage space is not created.

Aside from supply and demand components, one other force driving oil costs has been investors and speculators bidding on oilfutures contracts. Many majorinstitutional investorsnow involved within the oil markets, such aspensionandendowment funds, maintain commodity-linked investments as a part of an extended-time period asset-allocation technique. Others, includingWall Streetspeculators, commerce oil futures for very brief periods of time to reap quick income. The result is extra demand for the commodity driving the spot value larger. The spot price is the value where a financial instrument is presently buying and selling at proper now.

- In this module you can learn about it’s demand & supply, relationship with gold and points to remember when trading it.

- Our team of commodity trading experts, guides you to wisely expand your valuable assets according to your current portfolio while assessing your expected objectives in commodity trading in India.

- The details about lot sizes / delivery lot can be obtained from the respective exchanges’ website.

- Consequently, backwardation causes traders to revenue when rolling expiring futures contracts to futures contracts expiring at a later month.

Get in touch with us and get an insightful way to wondrous investment opportunities in today’s time. Usually it is the average of the spot prices of the last few trading days before the contract maturity. It is the extra margin imposed by the exchange on the contracts when it enters the concluding phase i.e. it starts with tender period and goes up to delivery/settlement of trade. This amount is applicable on both the outstanding buy and sell positions. Arbitrage is making purchases and sales simultaneously in two different markets to profit from the price differences prevailing in those markets.

Since spot price cannot fall beyond a point, it is the futures that will expand normally. The only way out of super contango is for the supply of a commodity to fall sharply or for more storage space to be created or for the inventories to be rapidly used up. Prevent Unauthorized Transactions in your demat / trading account Update your Mobile Number/ email Id with your stock broker / Depository Participant.